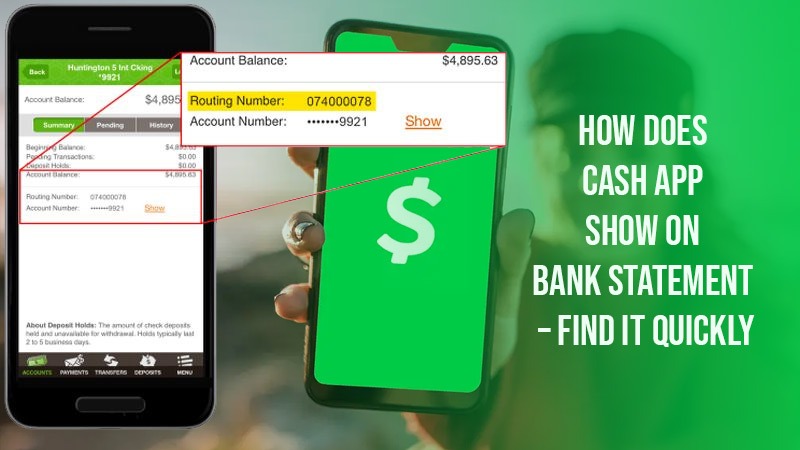

Cash App figures on the list of the most-used digital payment applications. The app is fully secure and keeps a record of all transactions that you participated in. These transactions can be accessed anytime. But being a regular Cash App user, you may wonder how does Cash App show on bank statement.

The Cash App transaction does appear on your financial statement monthly. But the exact manner of their appearance differs from one bank to another. You can learn which of your transactions came from the Cash App by accessing the personal tab on the app. This article lays down how the Cash App transactions show on your bank statement in more detail.

Related Resource:-How Should I Access My Cash App? – Fix Login Problems

How Does a Cash App Payment Display on Bank Statement?

No transaction that you enter in Cash App will ever get deleted. You can learn more about your transactions in the app by downloading the transaction history. Just navigate to the ‘Personal’ tab, locate your statement, and hit ‘Export CSV.’ Open the Excel file and view the transaction or print it.

The transaction will show up as follows:

- Description: The statement will have ‘Cash App’ in the transaction’s description. Alternatively, you might see ‘Square Cash’ written. You will view your name and Cashtag on the bank statement.

- Balance: The transaction’s amount and the applicable fee will be shown on the bank statement.

- Transaction type: You will also see the recipient of the funds. Along with that, the reason for the transaction will also be there.

- Date: The bank statement also has the date at which the transaction was processed.

POINT TO NOTE: Your bank statement will show each transaction on the Cash App. You can print it anytime to track your money properly. If it doesn’t show on the bank statement, wait for 24 hours.

Access Your Monthly Cash App Bank Statement in a PDF

It is easy to obtain your Cash App bank statement in PDF form. Just go through these pointers.

- On the home screen of the application, touch your profile.

- Select ‘Document’ followed by ‘Account Statements.’

- Now touch the ‘Print’ button.

- Another tab will appear. Here, touch ‘Print’ again.

- Now, choose the ‘Save as PDF’ option.

If you want to get the account statement in a PDF format, follow these points:

- On the Cash App’s website, access your monthly statement.

- After that, click the ‘Export CSV’ tab.

- Download your account statement.

- Now access your download history and open the monthly statement file.

- From here, you can print it in a PDF form.

What If Cash App Transaction Doesn’t Show on Your Bank Statement?

Your bank statement may not reflect the Cash App transaction immediately. The bank can delay the statement’s release for specific reasons. You must examine the limits on your Cash App and bank account before trying to view the statement.

- Log into your Cash App account.

- Enter your login information and the verification code.

- Now, check if payments have arrived in your account.

- If the transaction is made, you can view it on your bank statement.

- After that, print it to keep it handy.

What Are the Advantages of Accessing Cash App Transactions on Your Bank Statements

There are many benefits of accessing the Cash App transactions on your bank statement.

- Keep track of all your finances – You can easily keep a record of your Cash App transactions when they appear on your bank statement. It is especially useful for those using the app for budgeting.

- Transparency – When you have a list of all the transactions on your bank statement, you know the purpose of each transaction was made. It also helps you find out if a transaction was made by another person.

- Verification – Sometimes, you may be required to produce proof of the Cash App transaction. You can obtain it through the bank statement, as your transaction listed there.

How Can Cash App Transactions Track?

No. Your Cash App payments Do not track. A third party can only access your payment information if they have legal authority for it. You can, however, track your transaction history. To do so:

- Sign into the application and hit the ‘Activity’ tab.

- Here, you can view all your transactions and payments.

- Hit on a specific payment if you want to know more details about it.

DO REMEMBER- If you find your Cash App card stolen by viewing the history, disable it immediately. Tap the ‘Cash Card’ tab on your Cash App screen. Click the image of the card and enable Cash Card off.

Related Resource:-How to Delete Cash App Transaction History – Stepwise Process

Summing up

Now you know how does Cash App show up on bank statement. You will see the description, balance, transaction type, and date clearly on your bank statement. Obtain a PDF variant of it if you want to track money and be clear on where your money is going. Consult cryptocashapp experts if you need more clarification about it.

Frequently Asked Questions

How do I disguise Cash App on my bank statement?

You cannot hide your Cash App on your bank statement. But you needn’t do so because this data is completely private and only for you. Still, if you want to hide your Cash App from the bank statement, deactivate your account.

- Will my Cash App deposits reflect on the bank statement?

Yes, any Cash App transaction funded to or via your bank account will reflect on the bank statement. You can consult your bank to learn more about it.

- Will it cost me to receive Cash App statements from my bank?

Yes, if you want to receive your Cash App statement from the bank, you’ll need to pay a fee. This amount varies in different banks. So, check in with your banking institution to learn about it.

- Are my transactions and payments on Cash App private?

In Cash App all of your transactions are already private. It means that only you and the other individual or the sender or receiver of the payment can see it.